Medigap Plans - Commonly referred to as Medicare Supplement Plans

Medigap insurance policies are private plans, available from insurance companies or through brokers, but not directly from the government.

>

Medigap insurance plans are designed to cover the gaps in coverage left over by Medicare Part A and Medicare Part B, which together are known as traditional Medicare.

Commonly known as Medicare Supplement Plans, they are standardized in most states to options lettered A-N. Click on a link below to learn more about each specific plan:

Medigap Plan A: Covers Basic Benefits that are included in all other plans.

Medigap Plan B: Covers the Basic Benefits in Medicare Supplement Plan A plus S the Medicare Part A hospital deductible.

Medigap Plan C: Covers everything in Medicare Supplement Plan B plus the annual Part B Deductible, killed Nursing Co-Insurance and Foreign Travel Emergencies.

Medigap Plan D: Covers everything offered in Medicare Supplement Plan C without coverage for the Medicare Part B Deductible.

Medigap Plan E: Medicare Supplement Plan E has been discontinued.

Medigap Plan F: Covers everying in Medicare Supplement Plan C plus Part B Excess Charges. It is often called the 100% plan and is described as paying "everything."

Medigap Plan G: Covers everything that Medicare Supplement Plan F covers but not the annual Medicare Part B deductible.

Medigap Plan H: Medicare Supplement Plan H has been discontinued.

Medigap Plan I: Medicare Supplement Plan I has been discontinued.

Medigap Plan J: Medicare Supplement Plan J has been discontinued.

Medigap Plan K: Pays 50% of gaps with a an annual maximum out of pocket limit. Click for more details.

Medigap Plan L: Pays 75% of gaps with a an annual maximum out of pocket limit. Click for more details.

Medigap Plan M: Covers most gaps but has 50% of the Medicare Part A Deductible.

Medigap Plan N: Covers most gaps but with minor copays and no coverage for Medicare Part B Excess Charges.

*Plans C and F are no longer available to new Medicare enrollees and offer high deductible versions in some states.

Finding the Right Plan

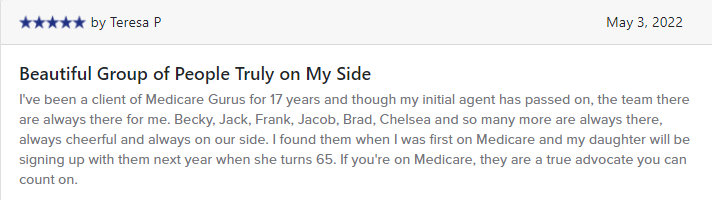

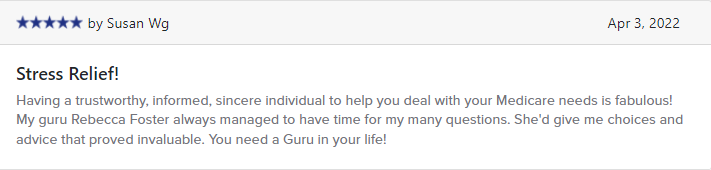

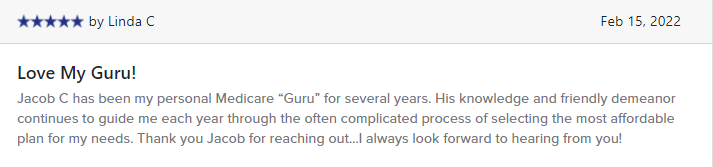

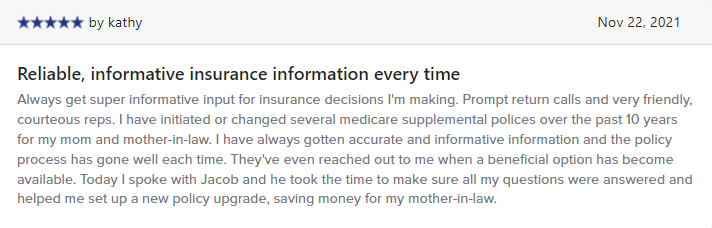

To determind which Medicare Supplement Insurance Plan is best for you, and to compare rates between over 30 Medigap Insurance companies for all offered plans, you can use the tools on this site or, better yet just remember that:

Medicare is easy when you call and get a Guru, CALL( 844) MY-GURUS, get a Medicare Guru.

What to Do When You Are New to Medicare

If you’re new to Medicare, you have a lot of learning to do and decisions to make. We're here to help. Call (844) My Gurus if you need assistance at any time.

1. Do not wait and put it off or procrastinate. The Medicare experience is a big world, it is a very big subject that can get very complicated quickly. So, the sooner you can start the process the more prepared you will be and the sooner you can relax, with the peace of mind that you are well taken care of.

2. Do not try to do it by yourself. Reach out and find someone who understands Medicare in detail and works with Seniors every day. Medicare has many complex options that can require attentive research. You don’t have a whole lot of time so it is very beneficial to find an Advocate that is knowledgeable and has your best interests at heart.

3. Do not go in with pre-conceived ideas. The healthcare that you had before Medicare is very different from Medicare so it is very important that you find someone that can guide you through the complications and dispel any misinformation that could accidently put you into a difficult situation.

The smart thing to do is to reach out to a Medicare Specialist and explain your needs to them. They can listen to your story and when they understand your specific situation they can help guide you to your best outcome. A good advocate can save you months of confusing worry and make the process smooth and efficient. More importantly, they can advise you on your options and help you find the best coverage at the best value. You can choose what you want and get what you need and understand exactly what you are getting and how it works.

Remember: